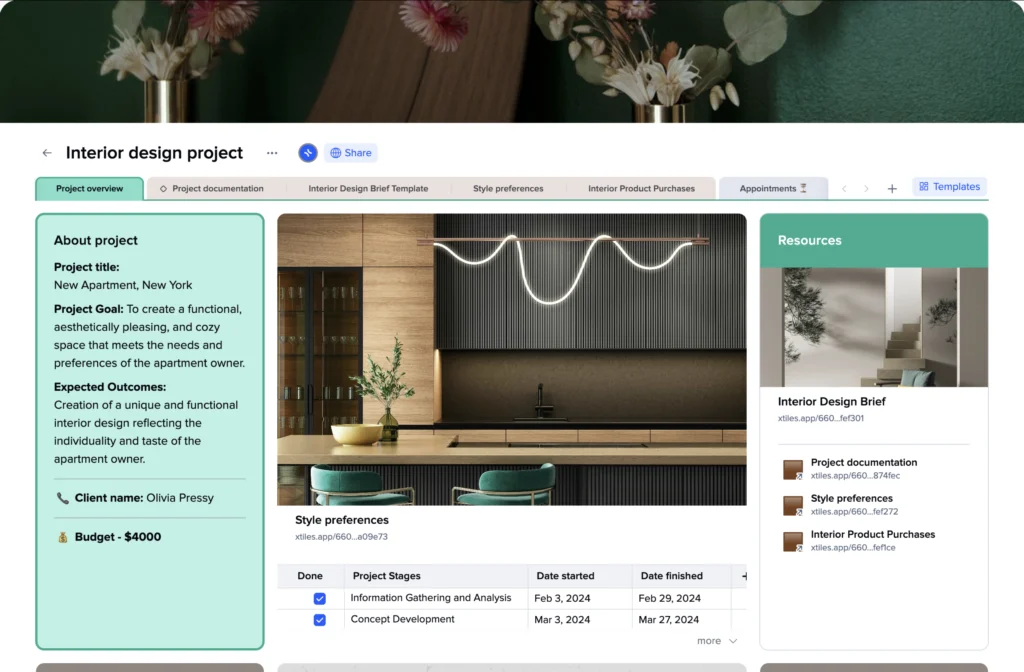

Finance Planner Template

Planning your finances might be a struggle, while spending your money is rather a pleasure. However, without a proper budget planner at your disposal, your finances won’t work for you at their maximum. There will always be some drawbacks and breaches, which are hard to identify when you don’t have a clear picture in front of you.

This xTiles Finance planner is an easy way for tracking your income and expenses. It will help you gain a comprehensive overview of your financial situation and make informed decisions about your spending habits.

Why this template will help you manage your finances

The xTiles Finance template will become an indispensable tool if you aim to keep control over your budget. Its huge benefit hides in its nature – it is a digital template, meaning there’s no chance it can be lost. You can access it from different devices no matter where you go and your data remains safe and protected.

People’s budgets can be chaotic, hard to read and understand, but with this planner you can easily categorize your expenses for better understanding. Every time you open it, you have a clear picture of your budget in front of you, so it will be easy to plan for future expenses and investments, set realistic financial goals and track your progress, and identify areas where you can cut costs and save money.

It also replaces other tools you might need to track your income and expenses, such as a calculator and automatic summing, ensuring there will be no mistakes.

If you have a shared budget with your partner, you can work on this worksheet together, each adding their spending or incomes. You can even add your personal pages if you decide that there’s a need for individual tracking alongside your shared finances. This collaborative approach guarantees independence while you’re both working on the same goals.